Mutf_In: Sbi_Mult_Asse_Msxklq

Mutf_In represents a pivotal strategy in investment management, particularly through the lens of Sbi_Mult_Asse_Msxklq. This approach emphasizes diversification and strategic asset allocation as essential tools for optimizing portfolios. By dissecting the fundamental principles of mutf_in, investors can enhance their analytical capabilities. However, the impact of these strategies in an unpredictable market raises intriguing questions about their long-term effectiveness and adaptability. What implications do these factors hold for future investment decisions?

Understanding Mutf_In: The Concept Explained

Mutf_In serves as a pivotal concept within the realm of financial analysis, particularly in the context of mutual funds.

Understanding mutf_in fundamentals is essential for investors seeking to navigate this sector effectively.

Its applications extend beyond traditional analysis, enabling stakeholders to assess performance metrics and optimize portfolio strategies.

This framework fosters informed decisions, promoting financial freedom through enhanced investment insights.

Key Features and Benefits of Sbi_Mult_Asse_Msxklq

The Sbi_Mult_Asse_Msxklq presents a robust framework for investors looking to diversify their portfolios through mutual funds.

This platform offers various investment strategies tailored to individual risk appetites, enhancing overall portfolio resilience.

Additionally, it facilitates effective risk management, allowing investors to navigate market fluctuations with confidence.

Ultimately, these features empower investors to make informed decisions while pursuing financial freedom and growth.

Real-World Applications and Case Studies

Real-world applications of Sbi_Mult_Asse_Msxklq illustrate its effectiveness in diverse investment scenarios.

Practical implementations include portfolio diversification strategies utilized by financial advisors, enhancing risk management through adaptive asset allocation.

Real-world examples demonstrate improved returns in volatile markets, showcasing the framework’s resilience.

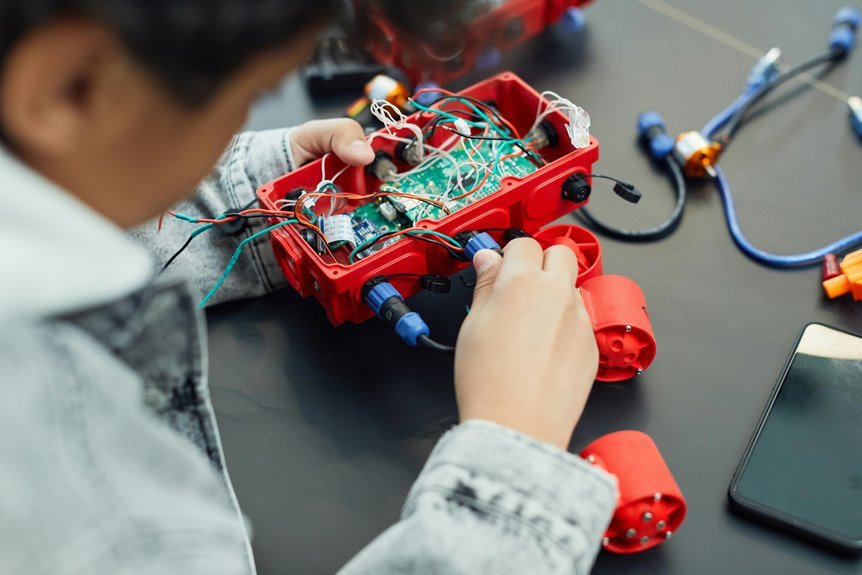

Future Trends: The Evolution of Multi-Faceted Assembly in Technology

As the landscape of investment strategies continues to evolve, the influence of multi-faceted assembly in technology becomes increasingly prominent.

Future trends indicate a shift towards adaptive assembly, driven by technological convergence. This integration will enhance efficiency and innovation, allowing systems to respond dynamically to market demands.

The synergy of diverse technologies fosters a transformative environment, empowering stakeholders to explore unprecedented opportunities in assembly processes.

Conclusion

In a world where investment strategies often resemble a game of chance, Mutf_In and Sbi_Mult_Asse_Msxklq stand as the wise sages, guiding investors through the chaotic landscape of mutual funds. However, one might wonder if understanding these intricate frameworks is merely a futile exercise in intellectual self-satisfaction, akin to assembling a jigsaw puzzle while the house is on fire. Ultimately, while these strategies promise growth and resilience, investors may still find themselves at the mercy of market whims.